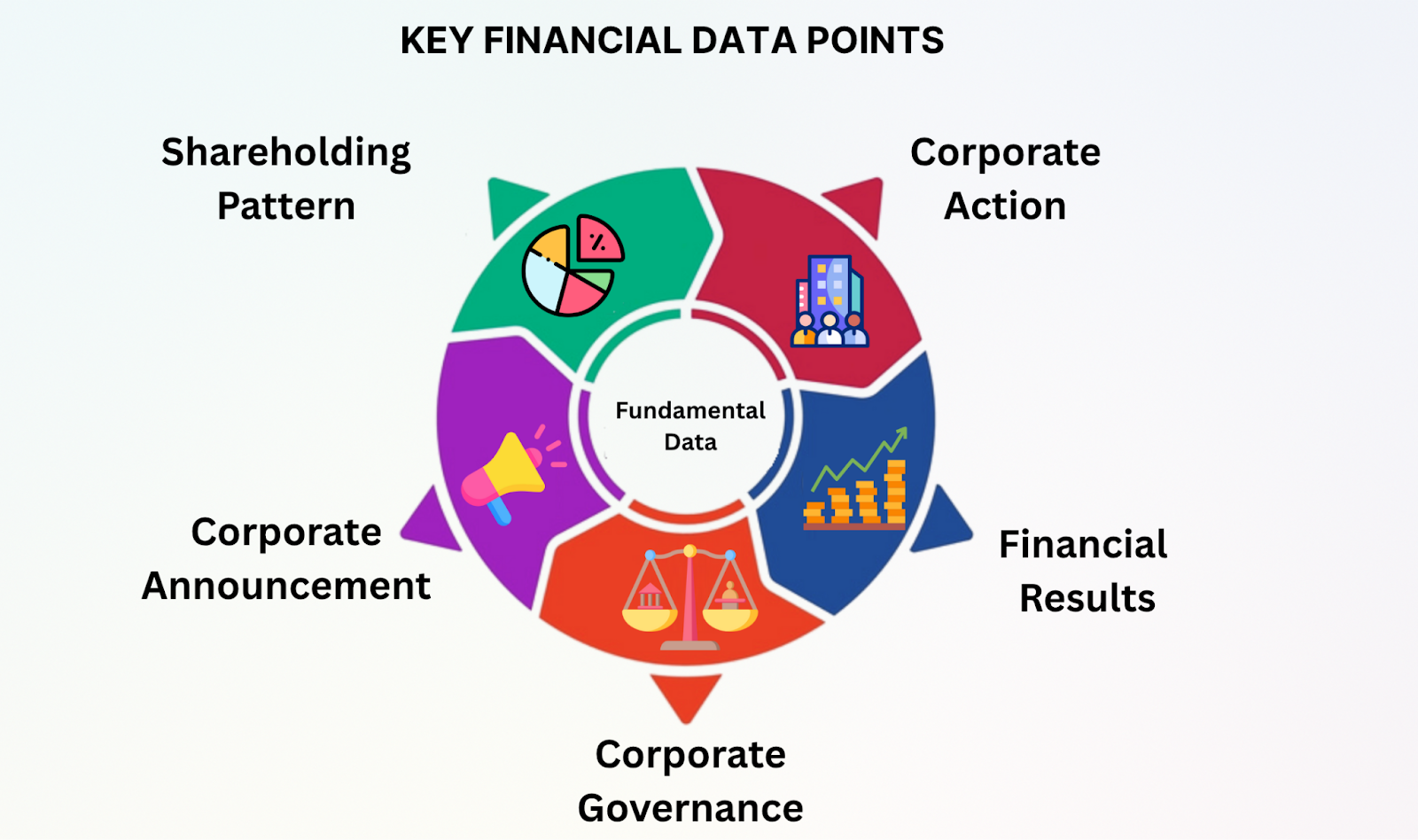

Fundamental data is generated when a company submits its financial and operational information to stock exchanges and regulatory bodies such as SEBI in India.

Fundamental data is also known as corporate data because it is provided by companies about their own performance, financial health, operations, and future potential.

Corporate data primarily includes balance sheets, income statements, cash flow statements, annual reports, quarterly earnings, revenue, profits, debt, assets, liabilities, news, corporate events & announcements, their promoters, and management decisions and much more. This fundamental data helps determine a company’s intrinsic value and is closely studied by investors, traders, analysts, and institutions for financial asset building.

Hence, fundamental data forms the backbone of every investment and trading decision.

Key Benefits of Using Fundamental Data for Traders and Investors

Following represents the Key benefits of using fundamental data for traders and investors

- For every trader these data points help traders respond quickly to market movements and news-based volatility.

- Corporate Announcements –

Timely updates on dividends, mergers, acquisitions, or board decisions that may influence stock prices.

- Bulk/Block Deals –

Reflect large-volume trades by institutions or insiders – potential signals of short-term price movement.

- Promoter’s Pledge –

Shows whether company promoters have used their shares as loan collateral. A high pledge may signal financial stress and can lead to stock price swings.

- Corporate Actions (e.g., Bonus, Split, Rights Issue) –

Affect stock price and liquidity, critical for planning short-term trading strategies.

- Voting Results –

Can hint at upcoming changes in governance or strategy – impacting near-term market perception.

2. For every investor or long-term value seekers use these indicators to assess company health, profitability, and strategic positioning.

- Financial Statements (Cash Flow Statement, Income Statement, Balance Sheet) –

Core data to evaluate a company’s financial structure, income generation, and cash management.

- Annual Reports & Quarterly Results –

Keep an eye on performance, growth plans, risk factors, and management commentary.

- EPS (Earnings Per Share) –

A measure of profitability per share, useful for valuing and comparing companies.

- Book Value –

Represents the net value of the company – helps identify undervalued or overvalued stocks.

- ROE (Return on Equity) –

Indicates how efficiently a company uses shareholder funds to generate profit.

- Dividend Yield –

Reflects return of income from dividends relative to price of a stock – ideal for income-focused investors.

- Debt-to-Equity Ratio –

Measures a company’s financial leverage and long-term risk.

- Future Profit Outlook (Forward PE Ratio, EPS Growth) –

Useful for forecasting earnings potential and evaluating valuation relative to growth.

- Moat (Competitive Advantage) –

Analyzes long-term sustainability through strong brand, innovation, or market dominance.

- Company/Promoters Information –

Assess credibility, experience, and vision – crucial for long-term value investing.

3. Useful for Both Traders & Investors

- Market Capitalization –

Helps categorize stocks into large-cap, mid-cap, or small-cap, influencing strategy and risk tolerance.

- Sector Classification –

Essential for benchmarking, sector rotation strategies, or diversification.

- Shareholding Patterns –

Investor confidence indicator – tracking changes in promoter or institutional holdings.

- Macroeconomic Indicators (GDP Growth, Inflation, Interest Rates, Government Policies) –

Broad economic trends that influence market cycles, sentiment, and sector-specific opportunities.

- Corporate Governance –

Evaluates management ethics, transparency, and shareholder alignment.

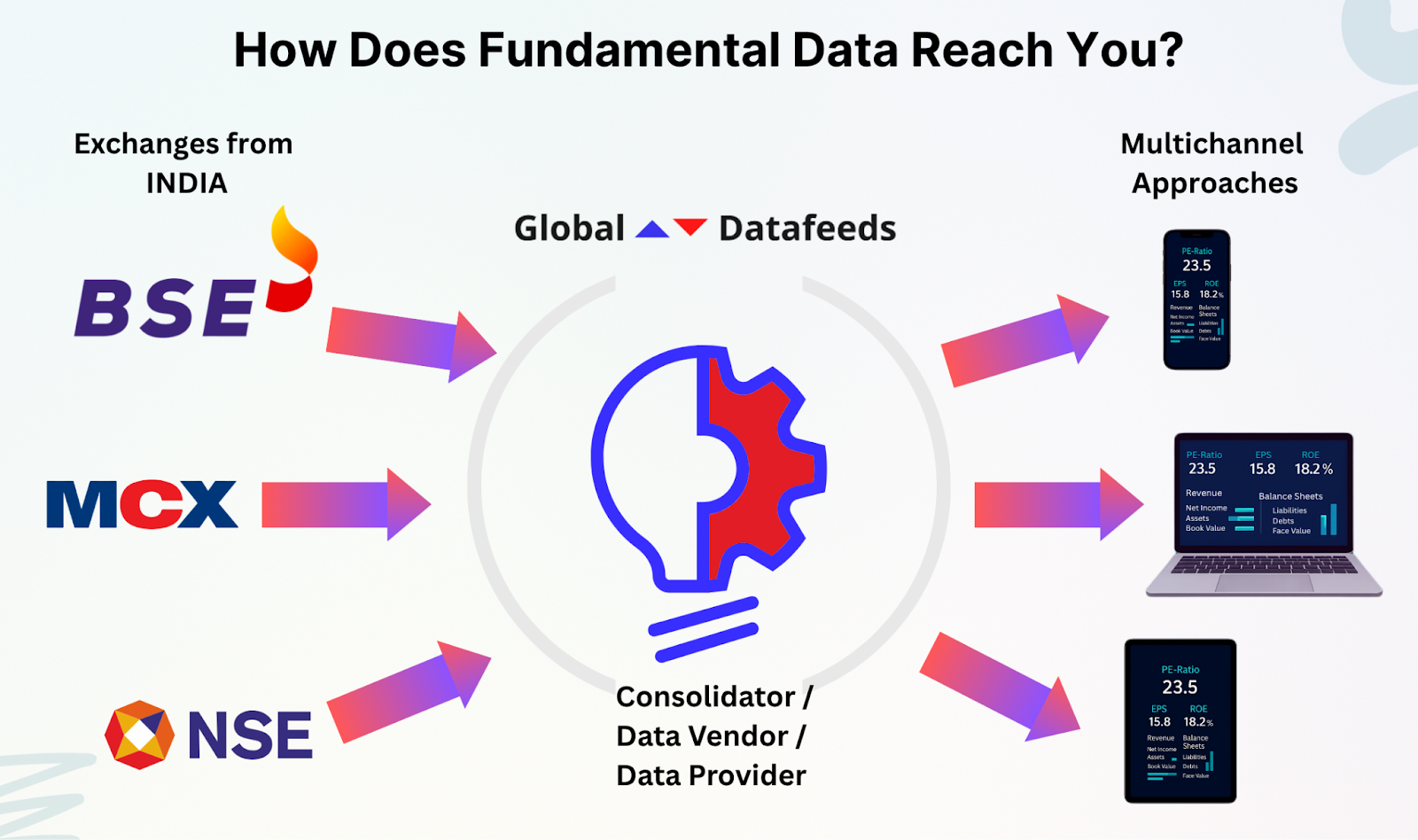

Who is a Data Vendor or Data Provider?

A Data Vendor or Data Provider is a trusted, exchange-recognized entity that holds legal authorization to distribute financial market data to investors and traders. These vendors are licensed to access live data directly from exchange servers – typically through secure channels such as leased lines. They process and format raw exchange data to ensure compatibility with trading platforms, enabling users to receive accurate, real-time market information essential for timely and informed decisions.

For over 13 years, Global Financial Datafeeds Limited (GFDL) has been a leading and reliable data vendor for NSE, NFO, BSE, BFO, MCX, and CDS, delivering seamless access to real-time, live, and tick-by-tick data.

Beginning in 2025, GFDL has expanded its offerings to include Fundamental Data, further empowering investors with deeper market insights.

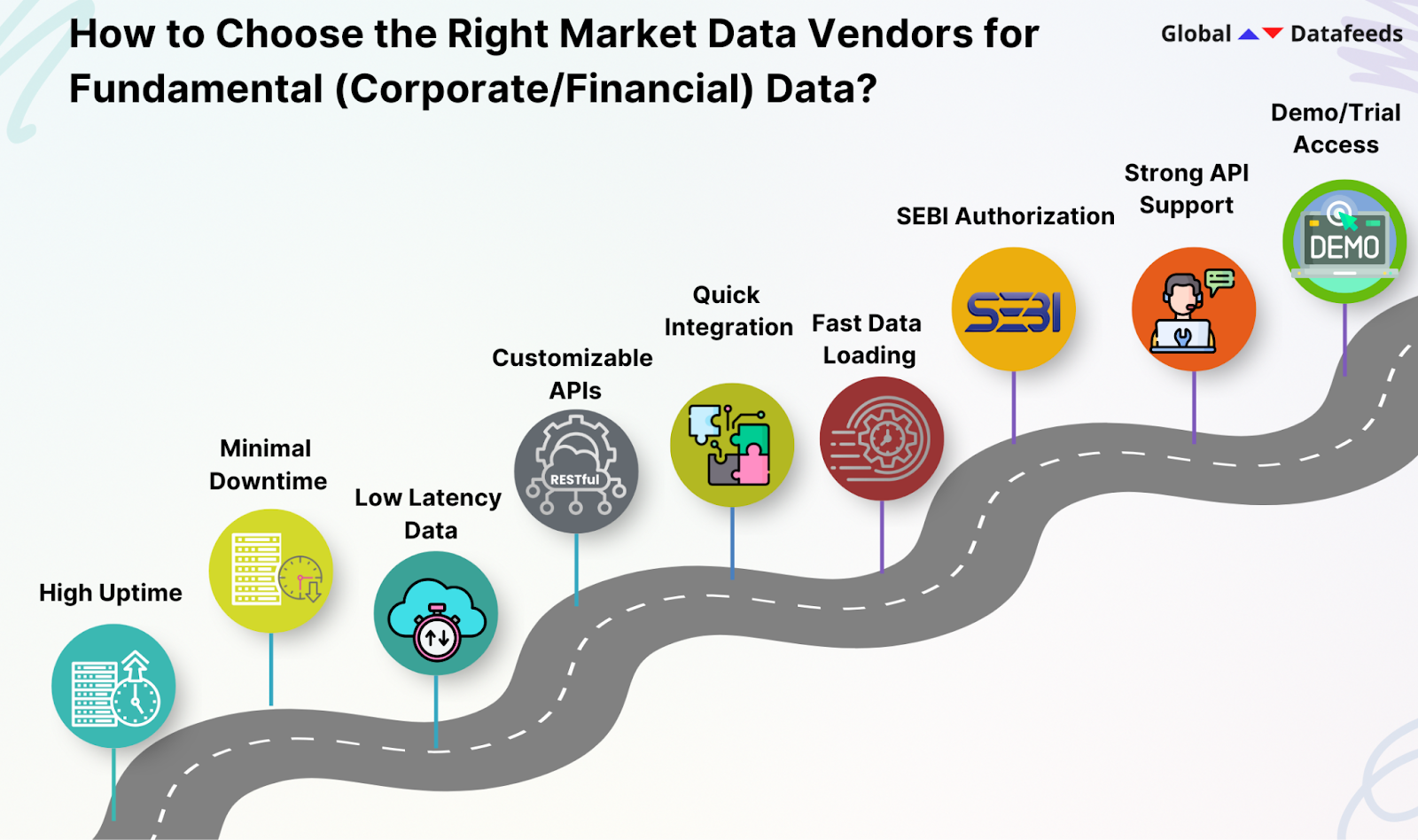

How to Choose the Right Market Data Vendors for Fundamental (Corporate/Financial) Data?

Combining real-time market data with accurate fundamental data offers a clear view for making informed trading and investment decisions. Therefore, selecting an NSE or BSE-authorized fundamental data provider becomes a critical step. Below mentioned are some essential key factors to consider:

- High Uptime – Ensure the provider delivers fast, reliable API responses with minimal lag for efficient data access and execution.

- Low Latency Delivery – Fundamental Data should be available seamlessly across web, mobile, and desktop platforms through multiple redundant channels.

- Customizable APIs – APIs must be flexible and support multiple programming languages, enabling tailored data extraction while avoiding unnecessary costs.

- Minimal Downtime – Opt for a vendor known for stable services and uninterrupted data flow, especially during peak market hours.

- Quick Integration – APIs should easily integrate with trading platforms, charting tools, or institutional systems for smooth data utilization.

- SEBI Authorization – Ensure the provider is SEBI-registered or approved, guaranteeing regulatory compliance and data authenticity.

- Fast and Accurate Data Loading – Fundamental data should load quickly and accurately to support rapid decision-making.

- Strong API Support – Choose a vendor that offers robust API performance along with dependable technical and customer support.

- Demo or Trial Access – A trial or demo offering is essential to evaluate the quality and suitability of the data before committing.

Why Choose GFDL as Your BSE-Authorized Fundamental Data API Provider?

In India, numerous financial data providers offer essential market information to investors, traders, and institutions. Among them, Global Financial Datafeeds Limited (GFDL) stands out as an Authorized and leading L1 Data Vendor (provider) in India, renowned for its accuracy, speed, and reliability. With a proven track record of delivering real-time, live, and tick-level data across platforms – whether mobile, desktop, or web – GFDL has become a preferred choice for market participants. There are many fundamental data providers but GFDL is the most trusted and reliable amongst various Indian stock market api providers in India.

Now officially recognized as an BSE-Authorized Fundamental Data Provider. GFDL is approved to deliver authentic and structured fundamental data for companies listed on the National Stock Exchange, making it a dependable partner for data-driven investing and analysis.

In addition, GFDL offers a robust BSE fundamental data API, making it easier for businesses, platforms, and analysts to integrate and use high-quality fundamental data in their own systems and tools. Company financial data contains the actual numbers and information needed to assess a company’s performance, helping investors make smart, long-term decisions.

With the help of an API for stock fundamental data, investors can easily access accurate and up-to-date financial information to make informed decisions.

Both approaches are useful, but if you’re investing for the long term, having a good understanding of the company’s fundamentals through reliable data is essential. It gives you confidence that your money is going into a solid and trustworthy business.

Many investors and analysts rely on financial data analytics companies like GFDL, a trusted financial data vendor, to access detailed and reliable information. GFDL provides detailed and accurate company fundamental data, helping users track a company’s performance over time. It also offers extensive corporate financial data and maintains a robust corporate actions database that records important events like dividends, stock splits, and mergers. As a trusted financial data vendor, GFDL makes it easier for investors to get accurate information quickly, empowering them to make better decisions in the stock market.

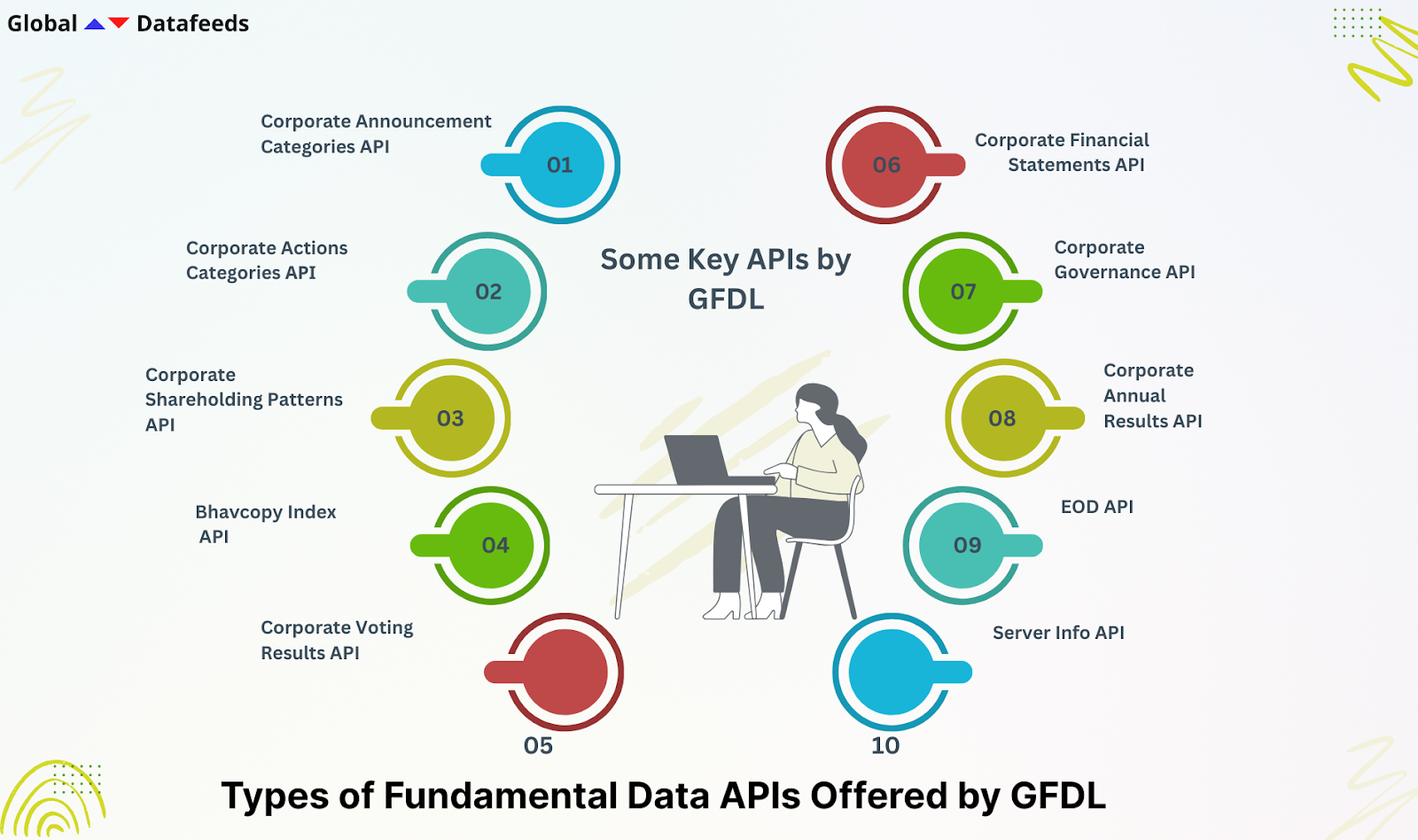

Types of Fundamental Data APIs Offered by GFDL

Corporate Announcement Categories API

Provides the available categories of corporate announcements for a given exchange. Developers using RESTful APIs for fundamental data can retrieve structured announcement types in JSON, XML, or CSV formats.

Corporate Announcements API

Delivers official disclosures about earnings, mergers, dividends, leadership changes, and events impacting stakeholders. This REST API for financial fundamental data is ideal for platforms developed with Swift, Go, or PHP stock fundamental data APIs, and supports CSVContent financial fundamental data output.

Corporate Actions Categories API

Returns a list of action categories per exchange. Developers can query objective-C stock fundamental data APIs or use Ruby financial fundamental data APIs to build sectoral analysis tools.

Corporate Shareholding Patterns API

Offers a breakdown of shareholder distribution across institutions, promoters, and the public. Highly useful for applications built with C stock fundamental data APIs, delivering financial fundamental data in JSON.

Corporate Voting Results API

Provides outcomes of shareholder votes on matters like board elections, mergers, and dividends. This fundamental data REST API supports transparency tools developed in R or OCaml financial fundamental data APIs.

Corporate Governance API

Returns governance details like board structure, transparency, executive compensation, shareholder rights, and corporate policies. Data can be accessed via shell stock fundamental data APIs in CSV, XML, or JSON financial fundamental data.

Corporate Financial Results API

Provides dates and summaries for financial result announcements. Useful for investors using RESTful APIs for financial fundamental data, compatible with tools built in Java or Python stock fundamental data APIs.

Corporate Financial Results Items API

Tracks specific result publications over time. Supported by HTTP financial fundamental data APIs and includes formats like CSVContent for flexible reporting.

Corporate Financial Statements API

Returns detailed periodic performance reports including balance sheet data, profit and loss data, cash flow statements, and financial ratios like PE ratios. Excellent for use in Ruby, Swift, or JavaScript stock fundamental data APIs.

Corporate Block Deals API

Returns bulk/block deals above threshold values when an investor or institution buys or sells a multiple quantity of shares within a trading session. Compatible with REST APIs for fundamental data.

Corporate Delivery Volumes API

Tracks the percentage of delivery-based trades. Useful for equity fundamental data analysis via Python or PHP financial fundamental data APIs.

Corporate Market Capitalization API

Provides market cap changes over time calculated using price multiplied by outstanding shares. It signifies movements in the stock prices, investor sentiment, and corporate actions for example buybacks or mergers. Supports objective-C financial fundamental data APIs for valuation and trend tools.

Corporate Promoter’s Pledge API

Returns pledged share info to analyze financial risk. Compatible with OCaml stock fundamental data APIs and real-time dashboards.

Corporate Annual Results API

Retrieves PDF-based annual performance reports. Integrated with company fundamentals API, supports Java and Python financial fundamental data APIs.

Corporate Company Data API

Returns registered company details, symbols, codes, and compliance data. Essential for company information APIs and stock market corporate actions analysis using RESTful APIs.

Corporate Sectoral Classification API

Retrieves sector, industry, and sub-industry classification. Use shell financial fundamental data APIs or Go for sector comparison tools.

EOD API

Provides end-of-day data for listed securities. Commonly used by applications using stock market data API NSE or stock market historical data feed API.

Bhavcopy Cash Market API

Returns daily cash market data including traded volume, open, high, low, close (OHLC), and turnover. Compatible with financial statement APIs in Java, C#, or Python.

Bhavcopy F&O Segment API

Returns derivatives segment data for options and futures. Integrated in real-time company news APIs or future data APIs.

Bhavcopy Index API

Returns index-level Bhavcopy for tracking benchmark performance. Works with stock market fundamental data APIs.

Circuit Filter Limits API

Lists companies hitting upper/lower circuit breakers. Supports volatility analysis in R, JavaScript, or Ruby financial fundamental data APIs.

Statistics Group A/B Companies API

Returns metrics for Group A & B companies. Works with equity fundamental data API and company financial data provider solutions.

Top 5 Gainers Losers API

Lists top-performing and underperforming stocks. Compatible with real-time stock news APIs and market news APIs.

Index Highlights API

Provides summary of index performance, change, and volume. Ideal for Indian stock market data API historical and financial data API tools.

Total Trade Highlights API

Summarizes trade activity across exchanges. Great for platforms that support Fundamental API for Indian listed companies.

Scrip Group Trade Highlights API

Returns trade summary by scrip group. Useful in Indian companies financial data platforms and stock fundamental data APIs.

Top 15 Scrips by Turnover API

Returns turnover data for top traded scrips in Group A. Used in financial fundamental data REST APIs.

Server Info API

Provides current API server endpoint details. Helpful during debugging with any RESTful API for fundamental data.

Limitations Info API

Returns user-level access control for allowed/disallowed exchanges. Supports usage analysis in fundamental stock data APIs.

EOD Statistics Get Series API

Returns changes in trading series like BL, BE, GC, EQ etc. Compatible with historical fundamental stock data APIs.

Banned Securities Info API

Lists currently restricted securities. Integrated in financial news API India and realtime alerts for BSE corporate announcements tools.

Key Benefits of Fundamental Data APIs by GFDL –

- Quick Uptime – Ensure the provider delivers fast, reliable API responses with minimal lag for efficient data access and execution.

- Low Latency Delivery – Fundamental data is available seamlessly across web, mobile, and desktop platforms through multiple redundant channels.

- Customizable APIs – APIs must be flexible and support more than 15+ programming languages, for data extraction to escape from unnecessary costs for additional data processing.

- Minimal Downtime – GFDL equipes Reliable & Stable Servers along with backup facility thus every user gets uninterrupted data flow, especially during fast market hours.

- Quick Integration – APIs should easily integrate with trading platforms, charting tools, or institutional systems for secure data utilization.

- SEBI Authorized – GFDL obeys all the essential guidelines led by SEBI guaranteeing regulatory compliance and data authenticity.

- Fast Data Loading – Fundamental data provided by GFDL load quickly as we have Cloud Servers for faster execution, thus there is almost no log or delay in API Calls execution.

- Strong API Support – GFDL provides all available customer and technical support via online chat, phone / WhatsApp / Discussion Forum / Email to resolve your queries.

- Demo /Trial Access – GFDL offers to generate the code, test the API and analyse response in our publicly available platform.

- `Cloud Based Fundamental APIs – GFDL offers APIs that are fully compatible with leading cloud platforms like Microsoft Azure, Google Cloud Platform (GCP), and Amazon Web Services (AWS), which together dominate over 60% of the global cloud market. This robust compatibility ensures high-speed deployment and performance, making GFDL the fastest provider of Fundamental Data for NSE & BSE Stock (Equity), Index & Commodities APIs in India.

- Robust API Response Parameters – GFDL provides over 200 detailed API response parameters specifically designed for fundamental data, enabling users to perform in-depth fundamental analysis with high precision and accuracy.

- Restful API for Fundamental Data – For accessing fundamental data GFDL offers RESTful APIs, here is why?

Why are RESTful APIs ideal for fundamental data?

- Structured Access: Supports retrieval of detailed financial statements, ratios, corporate announcements, and shareholding patterns.

- Standard Formats: Delivers data in JSON, XML, and CSV, making it easy to use in any language or platform.

- Wide Compatibility: Works seamlessly with Python, Java, JavaScript, PHP, .NET, and more.

- Scalability: Designed to handle large volumes of data efficiently with on-demand requests.

- Ease of Integration: Perfect for websites, analytics platforms, financial dashboards, and mobile apps.

- APIs are at affordable costs

GFDL, an L1 Data Vendor since 2010, is committed to delivering high-quality and secure data solutions. Our APIs are designed to be both cost-effective and efficient, offering competitive and budget-friendly services to meet diverse market needs.

Who Can Benefit from This?

Understanding and using BSE fundamental data api isn’t just for professionals – it can benefit a wide range of people in the stock market:

1) Traders

- Even short-term traders can use fundamental metrics to filter out low-quality or overhyped stocks.

- By identifying undervalued or fundamentally strong companies, they can reduce risks and make smarter trading decisions.

2) Long-Term Investors

- For those who believe in buying and holding stocks, fundamental analysis is a must.

- It helps investors understand the true value of a company, ensuring they invest in businesses with strong growth potential, healthy finances, and reliable track records.

3) Analysts

- Financial analysts and researchers often combine both technical as well as fundamental analysis.

- This gives them a more targeted view of the market, helping them provide accurate recommendations and gain a competitive edge in their insights.

4) Institutions

- Large institutions such as mutual funds, insurance companies, and pension funds rely heavily on fundamental data.

- They use stock fundamental data APIs to evaluate long-term investments, build robust portfolios, comply with regulations, and maintain transparency in reporting.

This way, whether you’re a beginner or experienced in the market, using api for stock fundamental data can give you financial success.

GFDL’s upcoming features in the fundamental financial data api will include:

· Quarterly Results Data

· Detailed Financial Statements (Balance Sheet, P&L, Cash Flow)

· Historical Fundamental Trends

· Ratio Analysis Over Time

· Sector-Wise Heatmaps

Our goal is to offer a complete suite of financial intelligence tools that meet the evolving needs of our users.